Is Juniper Networks For Sale? This question raises critical considerations for investors. The prospect of Juniper Networks being for sale hints at potential shifts in the tech landscape. Investors should think about the implications of such a major move. The company, known for its innovative networking solutions, has seen fluctuations in its market performance.

If Juniper Networks is for sale, several scenarios could unfold. Large tech firms may show interest, aiming to enhance their portfolios. This acquisition could create opportunities and risks for investors. Changes in leadership and strategy typically follow such sales, influencing stock values.

Investors must analyze their position carefully. Is it time to buy, hold, or sell shares? The future of Juniper Networks remains uncertain. Financial analysts will scrutinize the situation closely. Understanding market reactions is crucial. The phrase "Juniper Networks for sale" could signal new beginnings or conclude a chapter in the company's story.

The question of whether Juniper Networks is currently on the market sparks interest among investors. Reports have circulated about potential sales discussions. This information has led to mixed reactions in the investment community. Some see an opportunity, while others express skepticism.

Recent developments suggest that the company might explore strategic alternatives. Investors are curious about what this means for future growth. The possibility of new ownership could change the business landscape. There are advantages to fresh ideas and management styles. Yet, transitions like this can also disrupt operations. Investors should assess potential risks alongside possible rewards.

The uncertainty surrounding the sale adds a layer of complexity. Analysts are divided on how this affects stock performance. Investors must consider the company’s fundamentals amidst the speculation. Is it worth taking a risk now? The future remains uncertain, and decisions should be made carefully.

Potential buyers for a prominent tech company could come from various sectors. Major cloud service providers are always on the lookout for acquisitions. A strategic buy could enhance their service offerings. This merger could also provide instant access to new technologies and customer bases.

Telecommunications companies might see value, too. They often focus on expanding their network capabilities. Adding new technology can make them more competitive. With increasing demand for connectivity, these companies may wish to improve their infrastructure quickly.

Investors and industry experts are watching the situation closely. There are concerns about how a sale might impact stock prices and innovation. Some believe a sale could limit independent growth. Others feel it might unlock new resources for development. The future holds many uncertainties, and each potential buyer brings different risks and opportunities.

A potential sale of Juniper Networks raises significant implications for its employees and operations. The technology sector is witnessing an increased trend of mergers and acquisitions. In 2022 alone, the value of tech M&A transactions surged by 40%, amounting to nearly $1 trillion. This signals a competitive landscape where companies may refocus their strategies through consolidation.

For employees, uncertainty often accompanies such transactions. Job security may waver. A survey from the consulting firm found that 39% of employees express concerns about their roles during acquisition talks. This anxiety can affect morale and productivity. Employees may find themselves facing new managers and altered job descriptions. Integration processes can lead to redundant positions as firms strive for efficiency.

Operations may also shift dramatically. The strategic direction could change, affecting the company's innovation pipeline. Historical data shows that 70% of acquisitions fail to meet their intended goals, often due to poor integration. This puts pressure on existing teams. The balance of maintaining core operations while pursuing new strategies is crucial yet challenging. Companies must ensure that the workforce is adequately supported during transitions.

| Aspect | Details |

|---|---|

| Potential Buyers | Large tech firms, private equity firms |

| Employee Impact | Job security concerns, potential layoffs |

| Operational Changes | Integration of processes, strategy shifts |

| Investor Reactions | Stock price volatility, potential acquisition premium |

| Market Position | Influence on market competition, strategic partnerships |

| Future Prospects | Innovation potential, expansion opportunities |

Recent discussions about a potential sale of a major technology firm have stirred interest among investors. This is not just business chatter; the implications are significant. A sale could reshape the market dynamics. Investors need to weigh the risks against potential rewards. Change often leads to uncertainty, but it can also present unique opportunities.

Investors might find new partnerships emerging from a sale. Increased capital can drive innovation. However, integration challenges may arise. The new ownership structure could alter strategic goals, causing hesitation among some investors. Existing commitments might be jeopardized.

Additionally, stock volatility may follow any announcements. Market reactions are unpredictable. Investors must remain vigilant, as a sale could create both rewarding avenues and daunting challenges. Understanding these dynamics is crucial in navigating the investment landscape. The decisions made now will echo in the future.

This bar chart illustrates the stock price changes (%) of technology companies over four quarters amidst acquisition rumors and announcements. It reflects both positive and negative impacts on stock prices, highlighting potential risks and opportunities for investors.

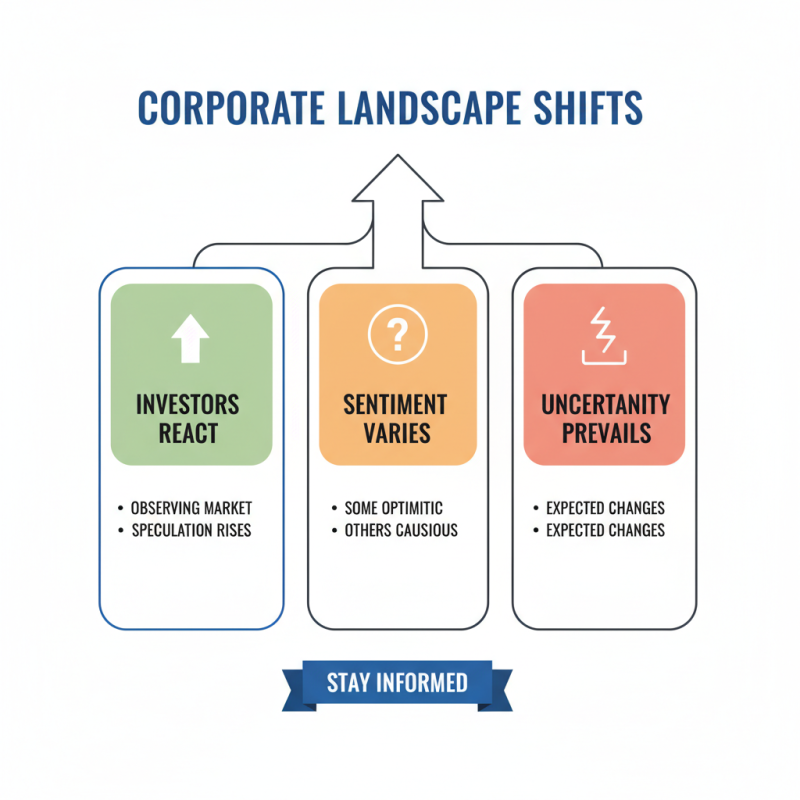

Recent reports hint at potential changes in the corporate landscape. Investors are keenly observing how these developments affect market dynamics. As speculation mounts, reactions are varied. Some are enthusiastic, while others are cautious. It’s not unexpected in a climate of uncertainty.

Market shifts can be revealing. Stock prices fluctuate as news breaks. Investors often react impulsively. Some might see opportunity, while others might fear losses. Each decision carries weight. Many investors are on edge, weighing risks against potential rewards.

Amidst the buzz, investors express mixed feelings. Some worry about possible disruptions. Others focus on long-term gains. How reliable is the information? Questions linger. Each investor must navigate their own path. Balancing hope with caution is a challenge. Understanding these dynamics is crucial in turbulent times.